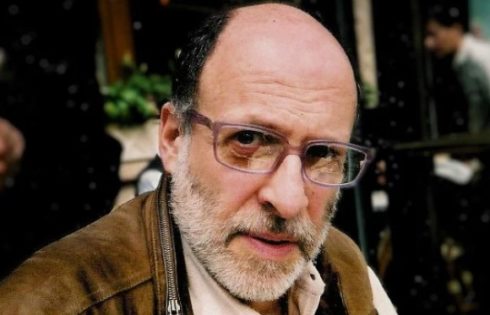

Eric Kingson, a professor of social work at Syracuse University, wants to help students by running for Congress as a Democrat.

Unfortunately, his policies on higher education would probably encourage colleges and universities to ignore the pleas of students and families and just keep raising tuition.

The Daily Orange reports that Kingson is challenging Rep. John Katko, a freshman Republican, for the slot representing the 24th District:

As a professor, Kingson said he believes that he has a special perspective and understanding of what college students face or want from a public figure, especially when it comes to student debt.

“It is wrong for young people to come out with a lot of debt,” he said. “We see the cost of education rising.”

Unsurprisingly for an academic with his pedigree, Kingson seems to have a poor grasp of economics:

“I will work at every level to make college affordable, (with the support of others) because not one person can do it on their own,” he said.

In order to combat this, Kingson said that if elected, he plans on supporting laws for lower interest rates on student loans. He added that the system needs to be reworked.

Lower interest rates are a direct incentive for schools to increase tuition. As Veronique de Rugy of the Mercatus Center has written:

In addition, by keeping student loan rates artificially low, the federal government is contributing to the rapid increase in college tuition. As it did in the housing market, free or reduced-priced money has artificially inflated the price of a college education.

Federal student aid, whether in the form of grants or loans, is the main factor behind the runaway cost of higher education. As Cato Institute economist Neal McCluskey explained in an April 2012 article for U.S. World & News Report:

“The basic problem is simple: Give everyone $100 to pay for higher education and colleges will raise their prices by $100, negating the value of the aid. And inflation-adjusted aid–most of it federal–has certainly gone up, ballooning from $4,602 per undergraduate in 1990-91 to $12,455 in 2010-11.”

Aside from tuition effect, lower interest rates have “little effect on college attendance or default rates” and throw taxpayer money at rich as well as poor students, according to Susan Dynarski, a professor of education, public policy and economics at the University of Michigan.

Writing in The New York Times, she said:

Interest-rate subsidies fail the tangibility condition: Students are handed the same funds whether the loan’s interest rate is 2 percent, 4 percent or 10 percent. Do the benefits of reduced interest rates arrive at the moment of decision-making? No, they arrive after students have left college — not when they are deciding whether to attend. …

But an across-the-board interest subsidy benefits every borrower, including those who have high earnings and no difficulty repaying loans. An interest subsidy is therefore a poorly targeted (and expensive) tool for reducing loan default.

Kingson’s other policies would give bankruptcy protection to students so they aren’t buried by debt, and extend a federal benefits program for children of disabled or deceased people so that it runs through college.

Like The College Fix on Facebook / Follow us on Twitter

IMAGE: Shutterstock

Please join the conversation about our stories on Facebook, Twitter, Instagram, Reddit, MeWe, Rumble, Gab, Minds and Gettr.