Federal regulations are further stressing out college financial aid offices across the country, according to a recent survey.

The survey, conducted by the National Association of Student Financial Aid Administrators cites compliance with federal changes to the Pell Grant and loan lending as sources as strain for financial aid offices.

Weighed down by bureaucratic policies, many financial aid offices have had to cut back on time spent advising students and parents on how to finance their college education, according to NASFAA Director of Communications Haley Chitty.

“Student loan counseling, student debt counseling is something that is very important, it is unique to each students and it’s more effective,” Chitty said. “Unfortunately, that seems to be one of the things that is suffering.”

Chitty said the year-round Pell Grant program has proved to be particularly time consuming for financial aid offices.

“The way the regulations were crafted, it’s a very labor intensive process and each students has to be reviewed intensively,” Chitty said. “It just takes a lot of staff hours to distribute a relatively small amount of aid.”

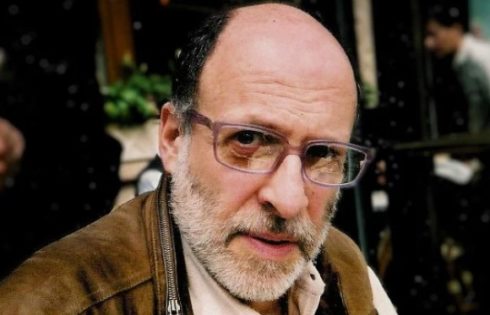

The Pell Grant may cause even more time consuming issues in the future, said Richard Vedder an economics professor at Ohio University and Director of the Center for College Affordability and Productivity.

Vedder said the new, year-round Pell Grant relies on stimulus funds which are quickly burning up and that many republicans, who control the House, have discussed doing away with the year-round implementation.

“When you expand the (Pell) program substantially, change the rules and allow for more students to get the grants, my guess is you’re in unchartered territory, therefore, there’s some transitional issues, “ Vedder said. “(But) when you’re talking about next fall, you’re not absolutely sure of what funding you’re going to have available as a college, so what to do?”

Chitty said an increase in professional judgments, where a student applies for more aid in because of a sudden change in financial circumstance, have also proved burdensome for many financial aid offices.

“Specifically with the downturn in the economy, we saw a big uptick in the number of professional judgments,” Chitty said. “Each student has to be considered on a case-by-case basis, it’s in federal regulations.”

One group representing private colleges across the country, The National Association of Independent Colleges and Universities (NAICU), said they were not surprised by NASFAA’s findings.

“For colleges forced to cut back on administrative costs at the same time they are being asked to deal with a sharp increase in aid applicants, the growing burden of federal regulatory compliance couldn’t come at a worse time,” said Tony Pals, NAICU director of communications, via e-mail. “The bottom line is regulations designed to help consumers are now hurting financially needy students.”

Chitty said a simplified process could help aid offices that are unable to balance a decrease in resources and an increase in federal regulations.

“We recognize that everyone is struggling with tight budgets from campuses to federal government,” Chitty said “We’d like to see programs streamlined into on federal grant program, one federal loan program, one federal work study program. Currently, there’s several different kind of loans.”

Currently, there are over 15 federal loan, work-study and grant financial aid programs, according to studentaid.ed.gov.

Vedder said his organization, too, would like to say a slimmed down version of the federal aid program.

“If it were up to us, we’d probably recommend to restrict federal loan programs to truly poor people,” Vedder said. “Then we’d convert to a voucher program. Money would be given to the students instead of the financial aid offices. The students would be a little more empowered.”

Chitty said with more students applying for financial assistance, federal regulation will become more daunting for schools to follow.

“The ultimate impact of this is we’re at a time where students are relying more and more on student loans to finance their education,” Chitty said. “It’s difficult for students and families to understand how much to borrow.”

Amanda Seitz is the special reports editor for the Miami Student. She is a member of the Student Free Press Association.

Like The College Fix on Facebook / Follow us on Twitter

Please join the conversation about our stories on Facebook, Twitter, Instagram, Reddit, MeWe, Rumble, Gab, Minds and Gettr.